Early Payment Discounts – A win-win situation for both buyers and sellers.

How?

Businesses can get paid faster while customers can enjoy the savings. It’s certainly a good tactic to improve cash flow and customer relationships.

Though businesses have a wide array of ways to offer discounts and gain that competitive edge, 2/10 net 30 is one of the most common credit terms provided by businesses. Let’s dig into more details about this early payment discount.

First, understand 2/10 net 30 meaning.

What does 2/10 net 30 mean?

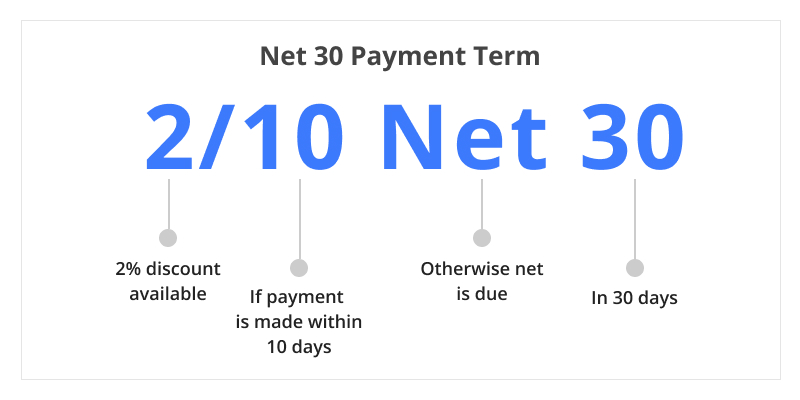

A trade credit term that provides a 2% discount, if the payment is done within 10 days

2/10 net 30 is an invoice term offered by the business to a customer. It means the buyer or the customer will receive a 2% discount on the total invoice amount if the payment is made within 10 days. If the customer does not make the payment within the first 10 days then the full amount (net) is due in 30 days without any discount.

2/10 net 30 calculation

Now that you’ve understood what is 2/10 net 30, we’ll crack the formula to calculate this term credit. The formula is quick and simple. The discount is generated by calculating the total amount of receivables and calculating the amount of discount.

Formula 1

Discount = Total Amount of Receivables x Percentage of Discount

So, the final formula goes like

2/10 Net 30 = Total Receivables – Total Discount

Another quick formula is

Formula 2

100% – Discount % x Invoice Amount

If this seems confusing, let’s take an example.

Example of 2/10 net 30 payment term

As a business owner if you opt to offer payment terms 2/10 net 30 to your customer then here is how it will be calculated.

For example –

Invoice full amount: $100,000

Invoice date: March 1

Invoice due date: 30 days

Payment terms: 2/10 net 30

Discount period: 10 days

So if the customer pays the amount within 10 days that is from March 1 through March 11 then an early payment discount of 2% will be applied.

As per the formula 1

Discount = 100000 x 2% = 2000

As per the 2/10 net 30 if the payment is done within 10 days

The discount will be applied which means $2000 will be deducted from the total amount receivable $100,000

2/10 Net 30 = $100,000 – $2000 = $98,000

Similarly, as per Formula 2

100% – 2% which is 98% x $100,000

That makes the final amount $98,000

However, if the customer makes the payment from March 12 to March 30

(after the first 10 days) then no discount will be applied. The payment amount due will be full – $100,000.

Other terms like 2/10 net 30

This term credit doesn’t need to be favorable for all businesses. For some businesses, if it strengthens cash flow then for some businesses, then it may be even difficult to survive with such discounts. Some businesses can also experiment by offering better early payment discounts and ensuring quick payments.

So if you are considering early payment discounts it is better to analyze how much discount won’t cause a cash crisis, what is standard for your industry, how late payment can impact your business, and other such financial factors. Accordingly, you can choose term credit.

Here are some trade terms alternative to 2/0 net 30. Opt that suits your business the best:

1/10 net 30

The 1% 10 net 30 calculation means the buyer or the customer will get a 1% discount on the total invoice amount if the payment is made within 10 days. Or else, the total amount is due within 30 days.

2/15 net 30

It means the buyer or the customer will be offered a 2% discount on the total invoice amount if the payment is made within 15 days. Or else, the total amount is due within 30 days.

2/10 net 45

It means the buyer or the customer will be offered a 2% discount on the total invoice amount if the payment is made within 10 days. Or else, the total amount is due within 45 days.

3/10 net 30

It means the buyer or the customer will be offered a 3% discount on the total invoice amount if the payment is made within 10 days. Or else, the total amount is due within 30 days.

3/20 net 60

It means the buyer or the customer will be offered a 3% discount on the total invoice amount if the payment is made within 20 days. Otherwise, the total amount is due within 60 days.

Cash in Advance:

Also known as CIA is a payment term that requires the buyer to pay for goods or services before they are delivered or provided. This method ensures that the seller receives payment upfront, mitigating the risk of non-payment and providing immediate cash flow.

Progressive payment terms:

Structured payment schedule where payments are made at various stages of a project or service delivery.

Best way to manage cash flow and ensure continued funding throughout the project. Here the initial payment is made upfront, followed by payments at predefined milestones or stages throughout the project, with a final payment upon project completion.

Net 20 EOM

No discounts. The customer is expected to make the full payment within 20 days after the end of the month.

Having your payment discount terms in writing can resolve a lot of issues. It is the best practice to include on invoice 2/10 net 30 or any other payment terms to make the customer aware of the payment due period and also let them know the benefit of paying earlier.

2/10 net 30 credit benefit

Both from the seller’s perspective and the customer’s perspective early payment discounts can be a great benefit. Trade credits are often provided to generate more frequent and high-volume sales. Offering discounts like 2/10 net 30 can not only attract huge sales but will also guarantee businesses quick or timely payments. High-profit margin companies can take good advantage of trade credits.

Customers appreciate the advantage of a 2% discount and they are likely to invest more. It also builds the trust factor among customers while businesses are confident about timely payment. So overall this strengthens the customer relationship.

Key benefits include:

Cash Flow Flexibility: Customers get 30 days to pay, thus improving cash flow management.

Encourages early payment: offering a 2% discount for payments made within 10 days.

Stronger Supplier Relations: Builds trust between suppliers and buyers with flexible payment options.

Increased Sales: Attractive terms can boost customer purchases.

Customer Retention: Favorable terms build long-term loyalty and encourage repeat business.

Inventory Optimization: Better cash flow facilitates managing stock levels with ease.

Market Competitiveness: Distinguish your business with advantageous credit terms.

Reduced Credit Risk: Incentivizes prompt payment, lowering the risk of defaults.

Financial Predictability: Provides reliable cash inflow and budgeting for better financial planning.

2/10 net 30 credit disadvantages

Everything has a downside and so does 2/10 net 30 terms too. The biggest disadvantage of this payment term is that no instant payment can be expected for sales. Since the due period is 30 days, there are chances of delayed payment.

Startups, freelancers, and small businesses that are dependent on cash flow cannot benefit from such early payment discounts. Sometimes, it may also lead to bad debts which can be a bigger risk.

Shortening due days like Net 15 or Net 21 can probably work out.

Key challenges include:

Impact on Margins: A 2% discount offered on invoices can reduce profit margins.

Cash Flow Pressure: Customers may be urged to pay early to take advantage of the discount, but this could impact their cash flow.

Financial Risk: Offering credit terms to unreliable customers can increase the risk of bad debts.

When to use 2/10 net30?

Implementing such a credit term requires careful consideration. Here are some cases where businesses can take advantage of the program.

New Customer Acquisition: in case, you have just launched a new product and are trying to attract new customers. Now offering “2/10 net 30” can entice new customers to purchase due to the potential cost savings.

Seasonal Business: If you have a seasonal business, Encouraging early payments through discounts helps ensure you have the necessary funds during critical periods and maximize cash flow during peak times.

Slow-Paying Customers: The idea is the best remedy for customers who typically pay their invoices late. Here The discount incentive can motivate these customers to pay earlier, reducing your collection efforts.

Large Orders: When a customer places a particularly large order then “2/10 net 30” can help maintain a steady cash flow and reduce the risk associated with a large outstanding balance.

Inventory Management: Faster payments allow you to reinvest in inventory sooner, keeping your supply chain moving smoothly.

Early Stage Business: If Your business is new and requires quick access to cash to fund operations, then early payments can provide the necessary working capital to support growth and operational expenses.

Credibility and Relationships: Offering favorable payment terms can strengthen customer loyalty and establish a foundation for long-term partnerships.

Economic Downturn: It is an economic downturn phase for your businesses and you’re cautious about what you spend. The discount can serve as an added incentive for customers to continue purchasing.

Cash Flow Management for Small Businesses: Early payments can provide small businesses with maintain necessary liquidity to handle day-to-day expenses and unforeseen costs.

Conclusion

The invoice payment terms are very crucial for businesses. Ultimately, it is about exploring payment options, testing different scenarios, and opting for which suits the best. Net 30 is standard, not mandatory, so businesses have the flexibility to pick any preferable term credit, shrinking from Net 15 to extending to Net 90.

The longer the payment is delayed, the worse your cash flow will be affected, particularly for freelancers and budding small businesses. Pick suitable invoice payment terms and see how your sales boost, cash flow increases, and your overall business witnesses growth.